Estate Planning

These days we all are spending more time to plan for a vacation, which car to buy, or even where to eat dinner than web other to worry to do to estate planning i.e. deciding who will inherit our hard earned savings after we’re gone. It may not be as fun to think about as booking a trip or checking out restaurant reviews, but without this aspect of life being taken care properly you can’t choose who gets what that you worked so hard for.

Estate planning, as generally misunderstood, isn’t only for the rich. Without a plan in place, settling your affairs after you go could have a long-lasting—and costly—impact on your loved ones, even if you don’t have a pricey home, large PF Balances, or valuable art to pass on. Consider some of the following to understand why you should have your estate plan in place and avoid potentially devastating consequences for your heirs.

Estate planning is all about protecting your loved ones. Hence there are many questions that you must ask yourself and when you start asking these questions, you start appreciating the need for it more. Here are few questions that you must ask yourself :

Estate Planning : Realities

Estate Planning Prevents Unintended Beneficiaries

If estate planning was once considered something that only high net worth individuals needed, that’s changed. Nowadays many middle-class families need to plan for when something happens to a family’s breadwinner (or breadwinners). After all, you don’t have to be super rich to do well in the stock market or real estate, both of which produce assets that you’ll want to pass on to your heirs. Even if you’re only leaving a second home behind, if you don’t decide who receives the property when you pass away, you won’t have any control over what happens to it.

That’s because a main component of estate planning is designating heirs for your assets, whether it’s a vacation home or stock portfolio. Without an estate plan, the courts will often decide who gets your assets, a process that can take years, rack up fees, and get ugly. After all, a court doesn’t know which sibling has been responsible and which one shouldn’t have free access to cash, nor will the courts automatically rule that the surviving spouse gets everything.

If you die without a will, which is a vital part of an estate plan, you are giving control in the hands of the court and the courts will decide who gets your assets.

It Protects Families with Young Children

Nobody thinks of dying young, but if you’re the parent of small children, you need to prepare for the unthinkable. This is where the will portion of an estate plan comes in.

To ensure that your children are cared for in a manner of which you approve, you’ll want to name their guardians, in the event that both parents die before they turn adult. Without such a will, the courts will again step in. This time it’s not to determine who gets a piece of real estate or artwork; may be to decide who will raise your children.

It Spares Heirs from a Big Tax Liability

Estate planning is all about protecting your loved ones, which means in part giving them protection from the Taxes these assets bring with it. Essential to estate planning is transferring assets to heirs with an eye toward creating the smallest possible tax burden for them. Even with just a little bit of estate planning, couples can reduce much or even all of their Income and Estate taxes, which can get very pricey. There are also ways to reduce the income tax the beneficiaries might have to pay. But without a plan, the amount that your heirs will owe to the Tax Department could be quite a lot.

It Eliminates Family Messes

We’ve all heard those horror stories: Someone with money dies and the war between family members begins. One sibling may think they deserve more than another, or one sibling may think that they should be in charge of the finances even though they're notorious for racking up debt. Such squabbling can get ugly and end up in court, with family members pitted against each other.

Stopping fights before they start is yet another reason why an estate plan is necessary. This will enable you to choose who controls your finances and assets if you become mentally incapacitated or after you die, will go a long way toward avoiding any family disputes and ensuring that your assets are handled in the way that you intend them to be.

It also will help you make individualized plans if necessary, to make arrangements for a child with health problems or set up a trust for one who might be better off not inheriting a lump sum. It can also help you give more to the child who did most of the work of caring for you in your later years or less to the one whose long education you funded, while paying far less for their siblings.

Deciding whether to divide your estate exactly equally is one of the key tasks you need to think through. And, of course, if you've had more than one spouse or have children from more than one family, an estate plan is urgent.

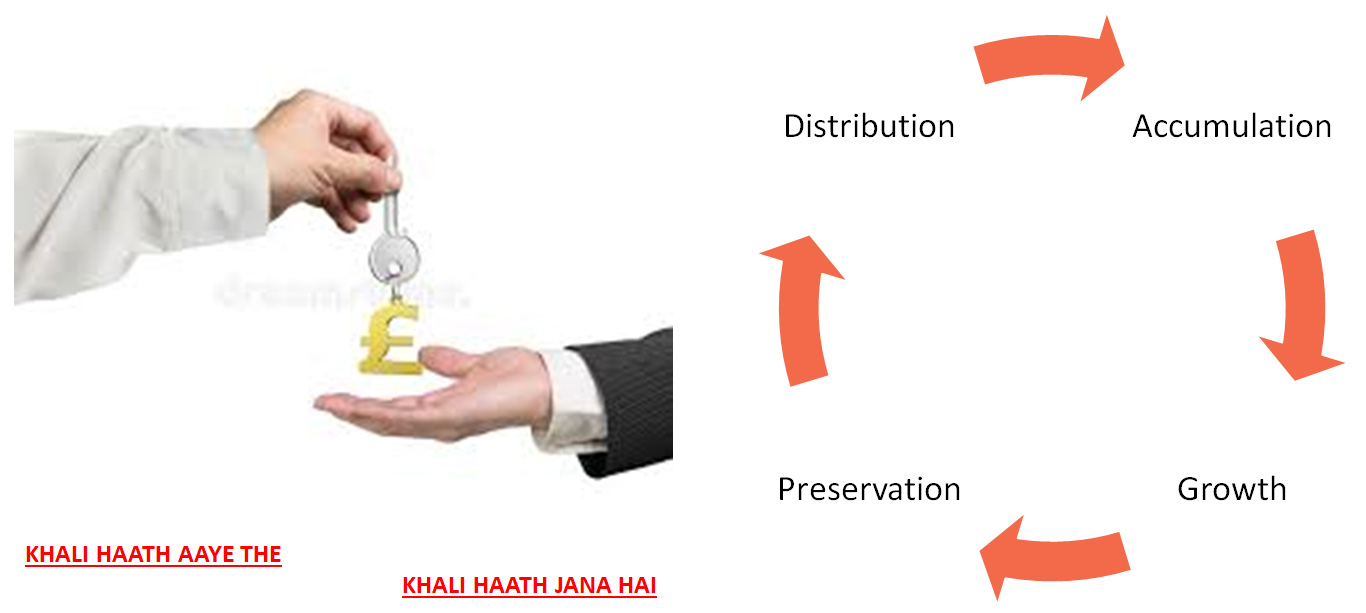

Estate Planning : Wealth Cycle

The Bottom Line, Estate planning allows you to choose who gets what. Estate planning affords you the chance to name your children’s guardian in the event of your early death. Estate planning helps you reduce taxes on what you leave behind. Estate planning minimizes the chances of family strife and ugly legal battles.

Finmoksha financial services through its partner network helps you get the best solution to your unique needs. To know more on this or to seek our help to get your Estate Plan done, please write to us at customercare@finmoksha.com